Taking out a loan can be a smart financial move, but it comes with costs. Your total loan cost includes the principal amount borrowed plus the interest and fees. Reducing this total cost can save you a lot of money. Here are detailed strategies to help you lower your loan expenses.

1. Shop Around for the Best Loan Terms

Before committing to a loan, compare offers from different lenders. Interest rates can vary widely between lenders. Lower rates mean lower overall costs. Check both traditional banks and online lenders. Look at the Annual Percentage Rate (APR), which includes interest and fees. The lower the APR, the less you’ll pay over the life of the loan.

2. Improve Your Credit Score

Your credit score greatly impacts your loan terms. A higher credit score usually results in lower interest rates. To improve your credit score:

- Pay Bills On Time: Make sure all your bills are paid on or before their due dates.

- Reduce Credit Card Balances: Aim to use less of your available credit.

- Check Your Credit Report: Regularly review your credit report for errors and dispute any inaccuracies.

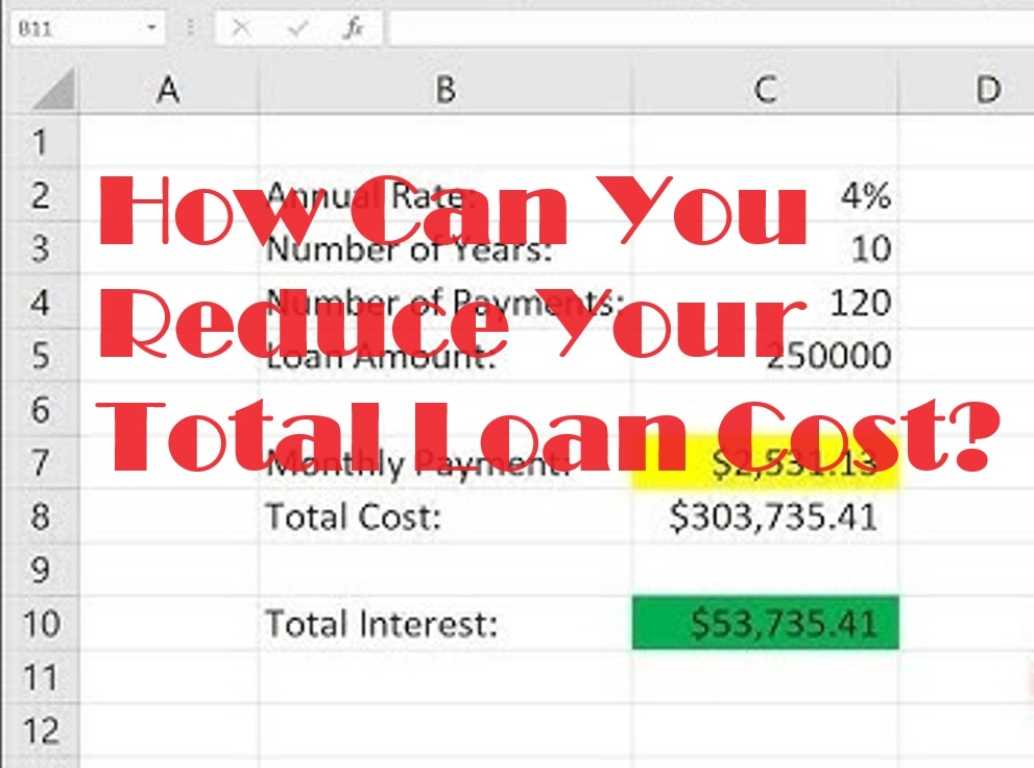

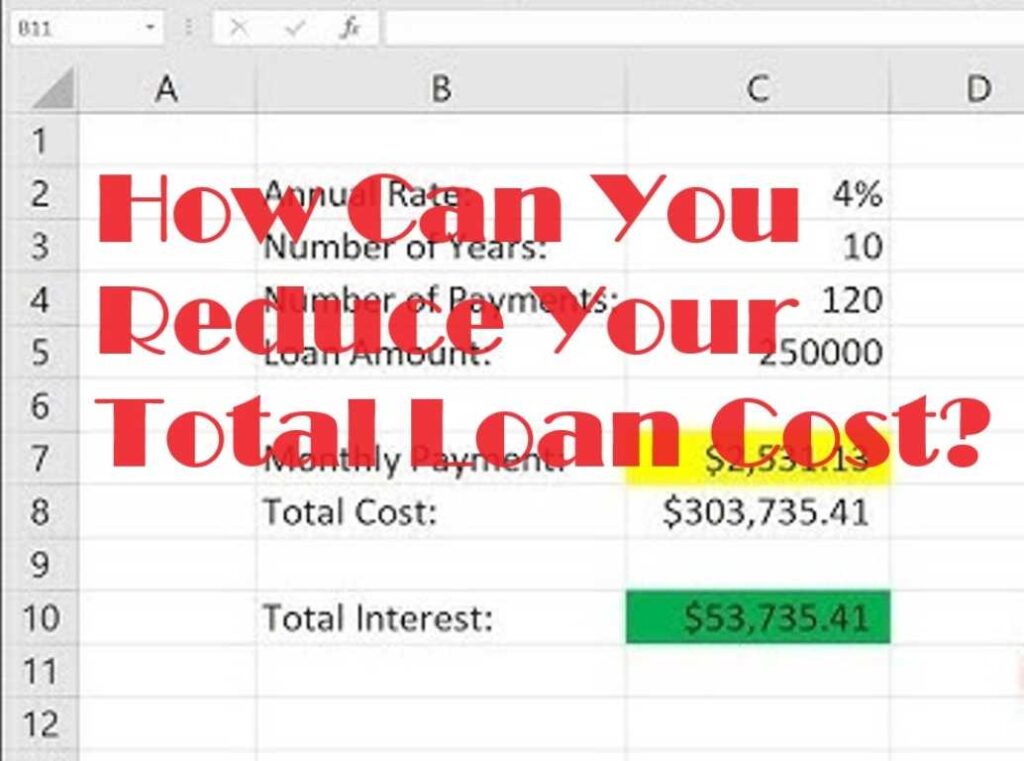

3. Choose a Shorter Loan Term

Shorter loan terms generally come with lower interest rates. While your monthly payments will be higher, you’ll pay less interest over time. For example, a 15-year mortgage typically has a lower rate than a 30-year mortgage. Carefully consider your budget to ensure you can handle the higher payments.

4. Make Extra Payments

Paying more than your required monthly payment can significantly reduce your total loan cost. Extra payments go directly towards reducing the principal balance, which in turn reduces the amount of interest you’ll pay.

- Monthly Extra Payments: Add a little extra to each payment.

- Lump-Sum Payments: Occasionally make larger payments when possible.

5. Refinance Your Loan

Refinancing involves taking out a new loan to pay off an existing one. Ideally, you refinance to a loan with a lower interest rate. This can lower your monthly payments and reduce the total cost of the loan. Keep in mind that refinancing may come with fees, so weigh the benefits against the costs.

6. Make Bi-Weekly Payments

Instead of making monthly payments, switch to bi-weekly payments. This means you’ll make a payment every two weeks, which results in 26 payments a year instead of 12. This extra payment each year can reduce the principal faster and cut down on the total interest paid.

7. Pay Attention to Fees

Loans often come with various fees. Some common ones include:

- Origination Fees: Charged for processing the loan.

- Prepayment Penalties: Fees for paying off the loan early.

- Late Fees: Applied if you miss a payment.

Be aware of these fees when choosing a loan. Look for loans with lower or no fees to reduce your total cost.

8. Consider Loan Consolidation

If you have multiple loans, consolidating them into a single loan can be beneficial. Consolidation might offer a lower interest rate and simplify your payments. However, make sure the new loan has favorable terms and that consolidation won’t extend your repayment period excessively.

9. Negotiate with Your Lender

Sometimes, you can negotiate better terms with your lender. If you have a good credit history and a strong relationship with your lender, they might be willing to offer a lower interest rate or reduce certain fees. It never hurts to ask.

10. Use Automatic Payments

Many lenders offer discounts for setting up automatic payments. Automating your payments can also help you avoid late fees and missed payments. These savings can add up over time.

11. Avoid Unnecessary Borrowing

Only borrow what you need. Avoid taking out more money than necessary, as this increases the total amount you’ll have to repay. Carefully assess your needs and budget before borrowing.

12. Monitor Your Loan Regularly

Keep track of your loan balance and interest payments. Regular monitoring helps you stay on top of your payments and notice any issues early. If you see any discrepancies or if your financial situation changes, contact your lender to discuss options.

13. Take Advantage of Special Programs

Some loans offer special programs or incentives. For example, certain mortgages have first-time homebuyer programs with lower rates or reduced fees. Explore any available programs that might help reduce your loan cost.

14. Pay Off High-Interest Loans First

If you have multiple loans, focus on paying off those with the highest interest rates first. This strategy, known as the “avalanche method,” minimizes the total amount of interest you’ll pay over time.

15. Consider Using a Financial Advisor

A financial advisor can help you develop strategies to manage and reduce your loan costs. They can offer personalized advice based on your financial situation and goals. This professional guidance can be especially useful for complex loans or large amounts of debt.

16. Avoid Unnecessary Loan Add-Ons

Some lenders offer add-ons like insurance or extended warranties, which can increase your total loan cost. Carefully consider whether these add-ons are necessary. Often, they are not worth the additional expense.

17. Review and Adjust Your Budget

Regularly reviewing and adjusting your budget can help you make extra payments or avoid financial strain. Ensure you’re managing your finances effectively so you can pay off your loan more quickly.

18. Stay Informed About Interest Rates

Interest rates fluctuate based on economic conditions. Keeping an eye on market trends can help you take advantage of lower rates when refinancing or negotiating new loans.

19. Plan for Future Payments

If you anticipate financial changes, such as a raise or a new job, plan how you can use this extra income to pay off your loan faster. Preparing in advance can help you reduce your total loan cost more effectively.

20. Avoid Taking on More Debt

Taking on additional debt while repaying an existing loan can increase your financial burden. Focus on managing your current loans before considering new ones.

Conclusion

Reducing your total loan cost involves a combination of strategies. From shopping for the best rates to making extra payments, each action can contribute to lowering your overall debt. By understanding your loan terms, improving your credit score, and managing your payments wisely, you can save a significant amount of money over time. Always stay informed and proactive about your loans to ensure you’re getting the best deal and reducing your costs as much as possible.